INFO PAGE

Health Care Security Ordinance

Employers with 20 or more workers must spend a minimum amount on health care for employees who work 8 or more hours per week.

Employer Annual Reporting Health Care Security Ordinance (HCSO) and Fair Chance Ordinance (FCO)

Join our LIVE webinar to learn how to fill out the form, best practices, and tips with the Office of Labor Standards Enforcement (OLSE) staff. The 2025 Annual Reporting Form (ARF) is due by May 1, 2026. If you are unable to attend, a recording will be available with the slide deck and posted on our website after the event.

Employers covered by the San Francisco Health Care Security Ordinance and/or the Fair Chance Ordinance must submit the 2025 Employer Annual Reporting Form no later than May 1, 2026, or be subject to a penalty of $500 per quarter.

Important Dates:

April 1 - ARF Form Available on our website

May 1 - Deadline to Submit ARF

Overview

Under the Health Care Security Ordinance (HCSO), all covered employers must meet the following obligations:

- Satisfy the Employer Spending Requirement by making required health care expenditures on a quarterly basis on behalf of all covered employees.

- Check the employer expenditure rate table for current rates.

- Covered employees are those who have been employed for more than 90 days and who regularly work at least 8 hours per week in San Francisco.

- Maintain records to show that you are in compliance with HCSO.

- Post the 2026 HCSO Poster (effective January 1, 2026) in all workplaces with covered employees.

- Submit a HCSO Annual Reporting Form to the OLSE by May 2, 2025.

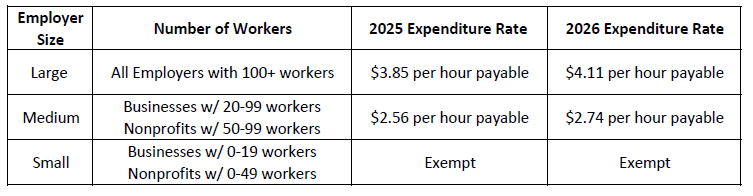

Employer expenditure rates

Find current and recent expenditure rates in the table provided. We also have an accessible version of the expenditure rate table.

Exemption Threshold: 2025 Exemption Threshold: managerial, supervisory, and confidential employees who earn more than $125,405 per year (or $60.29 per hour) are exempt. Starting January 1, 2026, managerial, supervisory, and confidential employees who earn more than $128,861 per year (or $61.95 per hour) are exempt.

Compliance options

Employers can choose how to spend the money on health care for their employees. Some of the common expenses include:

- Payments for health, dental, and/or vision insurance

- Payments to the SF City Option

- To learn more about contributing to the SF City Option, attend a training, visit www.sfcityoption.org, or contact SF City Option at employerservices@sfcityoption.org or (415) 615-4492.

- Contributions to programs that reimburse employees for out-of-pocket health care costs

Legal authority

Administrative Code and Rules

FAQ / Administrative Guidance

Get the full HCSO Administrative Guidance or browse by topic:

- A: Overview

- B: Covered Employers

- C: Covered Employees

- D: Calculating Required Health Care Expenditures

- E: Making Required Health Care Expenditures

- F: Revocable and Irrevocable Health Care Expenditures

- G: Contributing to the City Option

- H: Employer Notice-Posting Requirement

- I: Employer Recordkeeping Requirements

- J: Employer Reporting Requirements

- K: Health Surcharges

- L: Retaliation Prohibited

- M: Filing a Complaint

- N: Penalties

- O: HCSO and the Affordable Care Act

Advisory: The HCSO Administrative Guidance has not been revised to reflect all of the changes that took effect on January 1, 2017. Certain provisions of this Guidance, therefore, may not be consistent with the Health Care Security Ordinance ("HCSO"), San Francisco L.E.C. Article 21. In particular, no provision of the Guidance should be interpreted to mean that anything other than fully irrevocable Health Care Expenditures can be counted toward the employer spending requirement, as of first quarter of 2017. In any instance where the Administrative Guidance, or the Regulations, conflict with the Ordinance, the Ordinance itself governs and should be followed instead.

Resources

HCSO poster - Must be displayed at each workplace with covered employees.

- 2026 HCSO Poster (effective January 1, 2026)

HCSO Employee Voluntary Waiver form (PDFs)

Self-Funded Health Plans webinar and resources

Top-offs for 2025 Self-Funded Health Plans are due March 2, 2026.

- Download the HCSO Self-funded Instructions for 2025

- Download the Sample letter to employees regarding top off

- Watch the Webinar: Self-funded Health Plans Webinar, recorded January 28, 2026

- View Slides: Self-funded Health Plans Webinar, recorded January 28, 2026

Video resources

- HCSO videos

- OLSE-City Option Webinar recording (September 6, 2023)

Hearing Decisions

Contact us

If you have any questions about your rights or responsibilities, contact us: 415-554-7892 or email hcso@sfgov.org.

You can file a complaint if you believe your rights have been violated.